Hyundai Creta and Kia Seltos diesel hold value better than their petrol counterparts.

The midsize SUV space, often referred to as the ‘Creta segment’ is dominated by Hyundai, which despite wearing a Rs 11-20 lakh (ex-showroom) price tag, consistently features in the top-10 cars sold in the new car market, which is an incredible feat. To grab a piece of its pie, several players have entered the market namely, Kia Seltos, MG Astor, Skoda Kushaq, Volkswagen Taigun, Honda Elevate, Citroen Aircross, Toyota Urban Cruiser Hyryder and Maruti Grand Vitara. For this study, we focus on how these models fare in the used car space.

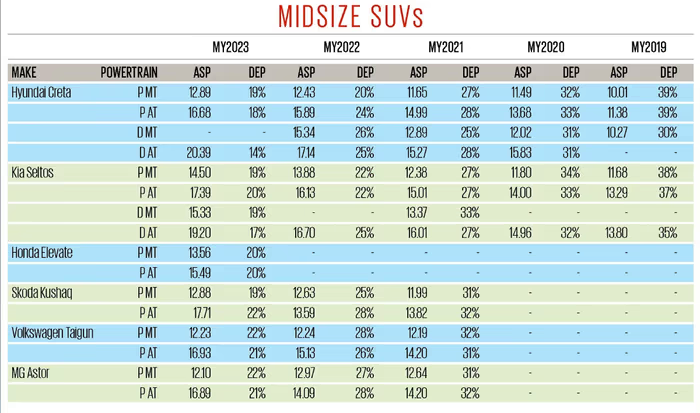

Used midsize SUV resale value study results

Skoda Kushaq, Volkswagen Taigun, and MG Astor exhibit similar depreciation patterns to each other.

*ASP stands for average selling price; DEP stands for Depreciation.

The Hyundai Creta’s strong brand equity propels its value in the used market. Particularly the diesel-automatic variants, which depreciate at the flattest rate over four years. Its sibling the Kia Seltos also exhibits a similar trend, although it is interesting to note that three year old examples depreciate slower than a corresponding Creta. An interesting observation is that for the most part, used diesel examples of the Creta and Seltos hold their value better than their petrol counterparts.

Rivals that entered the market in 2021 are the Skoda Kushaq, Volkswagen Taigun, and MG Astor, all of which exhibit similar depreciation patterns to each other. One-year old examples of the Honda Elevate hold their value a bit better than the abovementioned cars, since it is too new, it is too soon to come to any conclusions. Due to limited transaction data, models like the Maruti Grand Vitara, Toyota Urban Cruiser Hyryder and Citroen Aircross were excluded from this study.

Autocar India-Spinny Resale Value Study

This finding is based on a joint study conducted by Autocar India in collaboration with Spinny, a leading used car platform operational in 22 cities across India, including Delhi, Gurugram, Noida, Bangalore, Mumbai, Pune, Hyderabad, Chennai, Kolkata, Ahmedabad, Lucknow, Jaipur, Chandigarh, and Indore. Spinny provided average selling prices (ASP) derived from actual transactions of 21,944 cars sold across its network during the 2024 calendar year. For the purpose of the study, if a particular model had multiple engine options of the same fuel type, or came in multiple variants, these were merged and averaged. Depreciation was calculated as the percentage difference between a car’s on-road price in its year of manufacture and its resale price in 2024.

Also see:

Used Maruti Swift price is 73 percent of original even after 5 years: Autocar-Spinny study

Hyundai Verna resale value best among midsize sedans: Autocar-Spinny study

Used Tata Punch price propelled by new car demand: Autocar-Spinny study