For the third edition of our Used Car Study, we partner with Spinny to find out how different models across segments and brands fare in the pre-owned market.

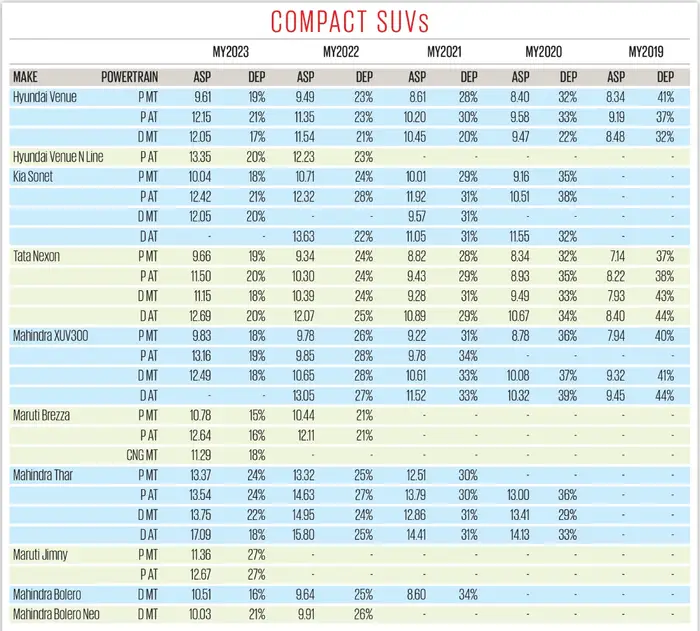

Over a period of five years, the diesel-manual iteration of the Hyundai Venue showcased the flattest depreciation trend compared to all other sub-4-metre compact SUVs. Interestingly, a five-year-old Venue diesel exchanged hands for 68 percent of its original on-road price; in other words, it depreciates by merely 32 percent over five years, which is commendable.

Autocar India-Spinny Resale Value Study

Hyundai Venue diesel depreciates slower than its segment rivals.

This finding is based on a joint study conducted by Autocar India in collaboration with Spinny, a leading used car platform operational in 22 cities across India, including Delhi, Gurugram, Noida, Bangalore, Mumbai, Pune, Hyderabad, Chennai, Kolkata, Ahmedabad, and more. Spinny provided average selling prices (ASP) derived from actual transactions of 21,944 cars sold across its network during the 2024 calendar year. For the purpose of the study, if a particular model had multiple engine options of the same fuel type, or came in multiple variants, these were merged and averaged. Depreciation was calculated as the percentage difference between a car’s on-road price in its year of manufacture and its resale price in 2024.

*ASP stands for average selling price; DEP stands for Depreciation.

Shifting focus to others in the segment, the Maruti Brezza and Tata Nexon share the top spots in the new-car market. But in the used car space, the second-generation Brezza, launched in 2022, holds its value exceptionally well in the first two years.

In terms of monetary value, prices of used examples of the Tata Nexon are among the least, while the Kia Sonet and Mahindra XUV300 (now rebranded as XUV 3XO) are among the most expensive.

The Mahindra Thar continues to command a reasonably strong residual value. On the other hand, on account of its slow demand in the new car market, a Maruti Jimny loses value rather quickly, depreciating 27 percent in the first year itself. Similarly, between the two Bolero models, the Bolero Neo depreciates faster than the classic Bolero, which benefits from a strong brand image and a dedicated customer base.

Also see:

Maruti Dzire holds 70 percent of its price after 5 years: Autocar-Spinny study

Used Toyota Glanza prices similar or lower than Maruti Baleno: Autocar-Spinny study