Despite Maruti’s dominance, the Hyundai Grand i10 Nios Petrol AMT stands out with the slowest five-year depreciation among rivals.

The hatchback segment in India is dominated by Maruti with four out of six offerings namely, Ignis, Celerio, Wagon R, and Swift. The only two non-Maruti cars in this segment include the Hyundai Grand i10 Nios and Tata Tiago.

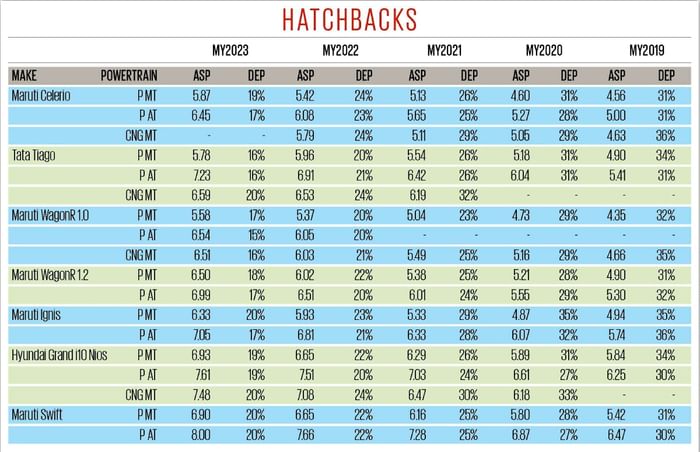

Used hatchbacks resale value study results

One- and two-year-old examples hold their value better than most competitors.

*ASP stands for average selling price; DEP stands for Depreciation.

All the four Marutis in this segment generally exhibit flat and predictable depreciation curves, offering strong value retention. However, among them, the Maruti Ignis shows a tendency to depreciate more rapidly after its third year, likely due to its niche appeal and limited market penetration.

What truly stands out is the Maruti Swift, which boasts an exceptional resale value of up to 73 percent even after five years, making it one of the most value-retentive hatchbacks in the market.

Despite Maruti’s stronghold, the Hyundai Grand i10 Nios Petrol AMT emerges as the surprise performer, registering the slowest average depreciation over a five-year period among its rivals. This underscores a growing trend in the hatchback segment: automatic variants command a significant premium (over their manual counterparts) in the used car market—mirroring their rising popularity in new car sales.

Interestingly, the Tata Tiago, particularly in petrol-manual form, shows impressive short-term value retention. One- and two-year-old examples hold their value better than most competitors, suggesting strong buyer confidence in the brand.

Autocar India-Spinny Resale Value Study

This finding is based on a joint study conducted by Autocar India in collaboration with Spinny, a leading used car platform operational in 22 cities across India, including Delhi, Gurugram, Noida, Bangalore, Mumbai, Pune, Hyderabad, Chennai, Kolkata, Ahmedabad, Lucknow, Jaipur, Chandigarh, and Indore. Spinny provided average selling prices (ASP) derived from actual transactions of 21,944 cars sold across its network during the 2024 calendar year. For the purpose of the study, if a particular model had multiple engine options of the same fuel type, or came in multiple variants, these were merged and averaged. Depreciation was calculated as the percentage difference between a car’s on-road price in its year of manufacture and its resale price in 2024.

Also see:

Hyundai Verna resale value best among midsize sedans: Autocar-Spinny study

Used Tata Punch price propelled by new car demand: Autocar-Spinny study

Used Toyota Glanza prices similar or lower than Maruti Baleno: Autocar-Spinny study

Maruti Dzire holds 70 percent of its price after 5 years: Autocar-Spinny study